The Ultimate Guide to Offer and get Home With Confidence and Relieve

Guiding through the real estate market can be daunting for both buyers and vendors - cash home buyers in St. Louis MO. Recognizing market fads and preparing funds are crucial actions. Furthermore, picking the best real estate representative can significantly influence the purchase's success. With various strategies available, understanding just how to come close to buying or selling a home is crucial. The complying with sections will certainly unbox these elements, assisting people toward certain and enlightened choices in their actual estate journey

Recognizing the Realty Market

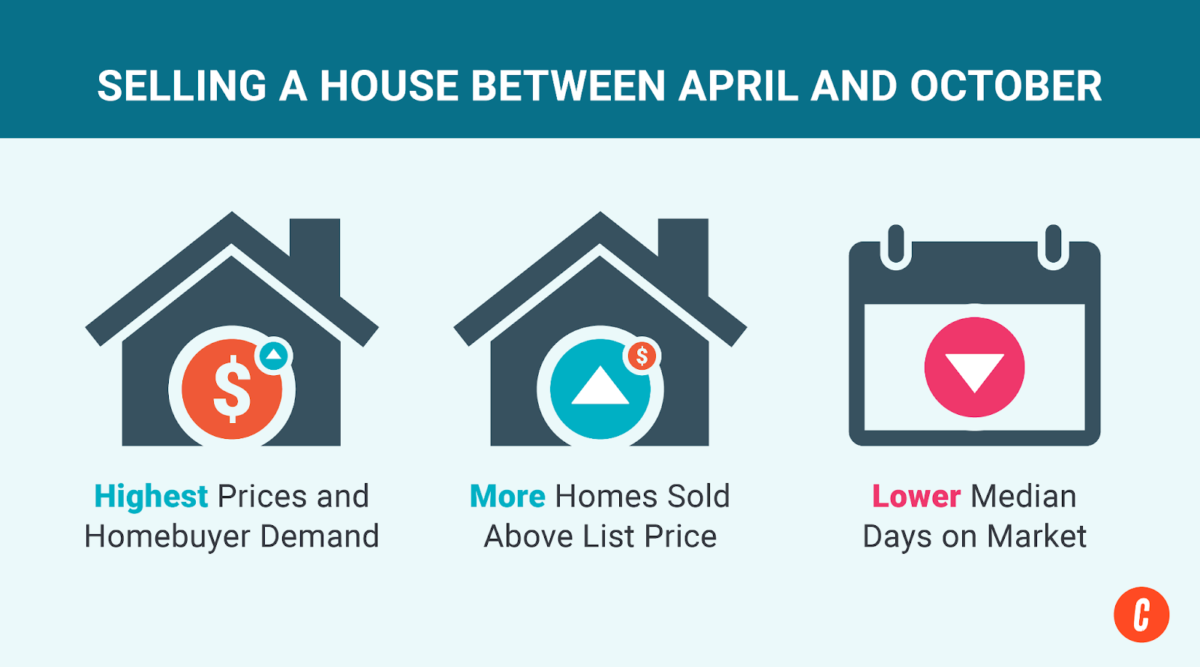

Recognizing the property market is essential for anyone seeking to get or offer a home, as it supplies understandings right into prices fads and demand changes. Market dynamics, including local economic conditions, rates of interest, and seasonal variants, play a crucial function in shaping customer and vendor behaviors. Buyers take advantage of acknowledging when to get in the marketplace, as costs may rise and fall based on supply and demand. Vendors, on the various other hand, must know just how their residential or commercial property's value is affected by comparable listings and recent sales in the location. Informed decisions stem from examining these variables, allowing both celebrations to browse arrangements properly. Ultimately, a comprehensive understanding of the real estate landscape encourages individuals to achieve their real estate goals with confidence.

Preparing Your Financial resources

Preparing funds is a crucial action in the home acquiring process. It involves evaluating one's spending plan, recognizing various funding alternatives, and checking the debt score. These elements are vital for making notified choices and ensuring a smooth deal.

Analyze Your Spending plan

Assessing a budget is an essential action in the home buying process. Buyers must first establish their economic capabilities to avoid overextending themselves. This includes analyzing income, cost savings, and current costs to establish a realistic rate variety for possible homes. It is crucial to represent additional costs such as real estate tax, maintenance, closing, and insurance charges, which can greatly affect overall price. By developing an in-depth budget plan, purchasers can identify what they can comfortably invest without compromising their monetary stability. Additionally, this evaluation helps purchasers prioritize their wants and needs in a home, ensuring they make informed choices throughout the purchasing journey. Eventually, a well-planned budget prepares for a successful home getting experience.

Understand Financing Choices

Browsing with the myriad of financing alternatives readily available is crucial for homebuyers wanting to secure the most effective bargain for their brand-new building. Purchasers must familiarize themselves with various types of home loans, such as fixed-rate, adjustable-rate, and government-backed loans, each offering unique advantages and qualification criteria. Understanding down settlement demands, passion prices, and finance terms can significantly affect total affordability - cash home buyers in St. Louis MO. Exploring choices like FHA finances, VA loans, and USDA financings can supply beneficial terms for specific purchasers. It's likewise important for homebuyers to assess alternative financing techniques, such as exclusive car loans or seller funding, which might present distinct opportunities. Ultimately, educated decision-making concerning funding can cause a smoother buying experience and higher economic stability

Examine Credit History

Just how well do property buyers comprehend the importance of inspecting their credit history before diving into the home getting procedure? Numerous potential purchasers underestimate its significance, yet a credit rating serves as an important sign of economic wellness. Lenders utilize this rating to assess the threat of extending credit report, affecting both loan authorization and rates of interest. A greater score can bring about better financing alternatives, while a lower rating might result in greater loaning prices and even denial of finances. Consequently, it is necessary for homebuyers to examine their debt records for precision, conflict any mistakes, and take actions to improve their scores if needed. By doing so, they improve their possibilities of securing beneficial mortgage terms, leading the way for an effective purchase.

Discovering the Right Realty Representative

Finding the right realty representative can significantly affect the success of a home acquiring or marketing experience. An experienced representative understands local market fads, rates methods, and settlement techniques. Prospective purchasers and sellers ought to look for suggestions from close friends or family and read on the internet reviews to assess an agent's reputation. It is vital to interview multiple representatives to assess their know-how, communication style, and compatibility with individual objectives. In addition, inspecting and confirming credentials for any kind of corrective actions can give understanding into professionalism and reliability. Ultimately, selecting a representative that demonstrates a strong commitment to client contentment can cause a smoother purchase procedure and an extra positive end result. A well-chosen agent functions as a valuable ally throughout the property trip.

Tips for Home Customers

When purchasing a home, customers need to focus on researching area patterns to understand market characteristics and property values. In addition, safeguarding funding alternatives is necessary to assure that they can afford their wanted home without monetary pressure. These fundamental actions can considerably affect the overall acquiring experience and future financial investment success.

Research Neighborhood Trends

Recognizing community fads is important for home buyers seeking to make enlightened choices. By researching regional market dynamics, customers can identify locations with potential for appreciation or decrease. Secret factors to think about include recent list prices, the typical time homes invest in the market, and the total sales volume. In enhancement, assessing group changes, college scores, and features can supply insights into community desirability. Buyers need to additionally recognize future developments, such as facilities jobs or zoning changes, that might affect residential or commercial property worths. Involving with neighborhood residents and actual estate specialists can provide extra point of views. Ultimately, comprehensive research study right into area patterns equips buyers to pick locations that straighten with their way of living and investment objectives.

Secure Funding Options

Securing financing options is an important step for home buyers, as it directly impacts their buying power and general budget plan. Customers should check out various financing methods, such as traditional financings, FHA loans, and VA financings, each offering unique advantages. A comprehensive understanding of rate of interest rates and financing terms is vital to make educated decisions. Furthermore, securing pre-approval from lending institutions can offer an one-upmanship in settlements, showing monetary preparedness to sellers. Home buyers need to consider their long-lasting monetary objectives and choose a home loan that lines up with their strategies. It's suggested to compare numerous lending institutions to discover the best prices and terms. Inevitably, a well-researched funding approach can equip customers to navigate the housing market with confidence.

Methods for Home Sellers

Efficient approaches for home sellers are crucial for achieving a successful sale in a competitive genuine estate market. Initially, pricing the home accurately is essential; performing a relative market analysis aids establish click for info an affordable rate. Next off, enhancing curb charm via landscape design and small fixings can draw in possible customers. Furthermore, staging the home to display its best features permits buyers to picture themselves residing in the area. Specialist digital photography is also crucial, as high-grade pictures can substantially raise passion online. Leveraging online advertising and marketing systems and social media can broaden the reach, drawing in more prospective purchasers. By executing these methods, home sellers can improve their opportunities of a profitable and quick sale.

Navigating the Closing Process

As customers and vendors approach the lasts of an actual estate deal, guiding via the closing procedure comes to be an essential action towards ownership transfer. This phase generally involves numerous essential parts, including the conclusion of documentation, the final walkthrough, and the transfer of funds. Customers ought to carry out a thorough evaluation of the closing disclosure, ensuring all terms align with the acquisition agreement. Alternatively, vendors must prepare for the transfer of keys and any kind of agreed-upon repairs. Involving a qualified property attorney or agent can improve this procedure, ensuring conformity with local policies and attending to any kind of final concerns. Eventually, clear communication in between all parties is essential to promote a smooth closing experience and secure the successful transfer of residential or commercial property ownership.

Post-Sale Considerations

After the sale is completed, buyers and sellers should usually browse a series of post-sale considerations that can greatly affect their experience - Sell your home in St. Louis MO. For customers, relocating into a brand-new home includes updating insurance plan, transferring energies, and addressing any kind of essential repair services. They should likewise acquaint themselves with neighborhood laws and area characteristics. Vendors, on the various other hand, might require to take care of monetary implications such as capital gains tax obligations and make sure that any type of staying commitments connected to the residential or commercial property are satisfied. Both celebrations ought to maintain open lines of interaction for possible disagreements and see to it that all files are effectively kept for future reference. By dealing with these considerations promptly, both buyers and sellers can delight in a smoother change into their brand-new situations

Frequently Asked Concerns

Exactly how Do I Choose Between Selling My House or Renting It Out?

Choosing in between selling or leasing a house entails assessing economic objectives, market problems, and personal circumstances. One should think about potential rental revenue, residential property monitoring responsibilities, and future housing requirements before making a decision.

What Are the Tax Effects of Marketing a Home?

When taking into consideration the tax obligation implications of offering a home, the individual need to account for funding gains tax, prospective exemptions, and any reductions connected to marketing expenses, which can significantly affect the last economic end result.

Just How Can I Determine My Home's Market price?

To determine a home's market worth, one should take into consideration recent sales of comparable properties, consult a realty representative, and examine regional market fads, making certain an extensive understanding of the home's well worth in current problems.

What Should I Disclose to Potential Purchasers?

When selling a home, it is necessary to disclose any type of known flaws, past fixings, and lawful concerns. Openness fosters depend on and can stop future conflicts, ultimately benefiting both the seller and potential purchasers throughout settlements.

How Can I Manage Several Offers on My Home?

Dealing with numerous offers on a home needs clear communication with all potential buyers. Evaluating deals based upon terms, backups, and financial toughness can aid vendors make educated choices, ultimately resulting in the most effective end result. In addition, this assessment assists buyers prioritize their demands and wants in a home, ensuring they make notified choices throughout the purchasing trip. When purchasing a home, purchasers must look here focus on investigating neighborhood patterns to understand market dynamics and residential or commercial property values. Recognizing community trends is necessary for home purchasers looking for to make educated choices. Protecting funding alternatives is an important step for home buyers, as explanation it straight influences their acquiring power and overall spending plan. Home customers must consider their long-term monetary goals and choose a home loan that lines up with their strategies.